Your 2024 Year-End Checklist for Employee Benefit Plans

Although the end of the year is a busy time, employers should continue to prioritize compliance requirements for their employee benefit plans. There are several benefits-related tasks that employers should make sure are completed by the end of 2024, such as:

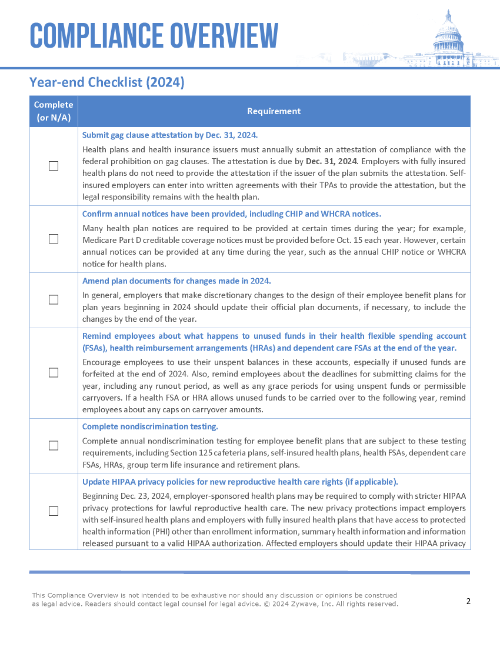

Although the end of the year is a busy time, employers should continue to prioritize compliance requirements for their employee benefit plans. There are several benefits-related tasks that employers should make sure are completed by the end of 2024, such as:- Submitting a gag clause attestation for their health plans (or confirming that an issuer or third-party administrator (TPA) submits the attestation)

- Amending plan documents for discretionary changes made for 2024

- Confirming annual notices have been provided, such as the Children’s Health Insurance Plan (CHIP) notice

- Performing any necessary nondiscrimination testing

In addition, employers should take steps to prepare for next year. For applicable large employers (ALEs), this includes making sure that health plan coverage will be affordable for full-time employees. Employers should also update employee benefit plan limits for 2025 and revise employee communications, such as summary plan descriptions (SPDs), for 2025 benefit changes.

Prepare for End of 2024

Tasks that may need to be completed by the year’s end include the following:

- Ensure gag clause attestation is submitted for the health plan

- Remind employees about rules for unused balances in FSAs and HRAs

- Send annual notices

- Perform nondiscrimination testing

- Amend plan documents

Prepare for Start of 2025

To prepare for 2025, employers should consider taking the following steps:

- Confirm health plan affordability (ALEs only)

- Update employee benefit limits

- Prepare to file ACA returns

- Update employee communications

View the full Compliance Overview containing a year-end compliance checklist for employee benefit plans below.

Links and Resources

- Gag clause attestation instructions and user manual

- Model notices for group health plans, including the Women’s Health and Cancer Rights Act (WHCRA) notice

- Model CHIP notice

Disclaimer

The material provided on this website is intended for informational purposes only. Links to other web sites are provided for reference and do not constitute a referral or endorsement by Pioneer or its affiliates. Please note that such material is not updated regularly and that some of the information may not be current. It is recommended that you consult with a financial professional for assistance regarding the information contained herein.

This Compliance Overview is not intended to be exhaustive nor should any discussion or opinions be construed as legal advice. Readers should contact legal counsel for legal advice.

© 2024 Zywave, Inc. All rights reserved.

Benefits services are offered through Pioneer Insurance Agency, Inc., a wholly-owned subsidiary of Pioneer Bank, National Association. Proud members of the National Association of Health Underwriters.

|

Not FDIC Insured.

|

Not Bank Guaranteed.

|

Not a Bank Deposit. | Not Insured by any Government Agency. | May Go Down in Value. |

|---|