The 50/30/20 Rule

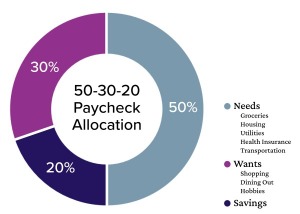

The 50/30/20 rule (also referred to as the 50/20/30 rule) is a simple approach to budgeting that can keep your spending in alignment with your savings goals. Budgets are more than just paying your bills on time – the best budget can help you determine how much you should be spending and on what. This budgeting rule simply divides your take-home income into three categories: 50% for needs, 30% for wants, and 20% for savings and/or debt repayment.

So here's how it works:

Step 1: Calculate Your After-Tax Income

Your after-tax income is what remains of your paycheck after taxes (state, local, income, Medicare, and Social Security) are deducted. If you're an employee with a steady paycheck, this can be easily done by taking a look at your paystub. If health care, retirement contributions, or other deductions are taken out of your paycheck, make sure to add them back in.

Your after-tax income is what remains of your paycheck after taxes (state, local, income, Medicare, and Social Security) are deducted. If you're an employee with a steady paycheck, this can be easily done by taking a look at your paystub. If health care, retirement contributions, or other deductions are taken out of your paycheck, make sure to add them back in.If you are self-employed, your after-tax income equals your gross income minus your business expenses, as well as the amount you set aside for taxes.

Step 2: Limit 50% of Your After-Tax Income to Your "Needs"

Your "needs" are the essentials, such as groceries, housing (mortgage or rent), utilities, health insurance, and transportation (car payments, car insurance, gas, passes, etc.).

Step 3: Limit Your "Wants" to 30%

Distinguishing between a need and a want isn't always easy and can vary based on who you ask. Generally, wants are the extras that aren't essential to living and working – these might include monthly subscriptions, travel, dining out, and entertainment.

Step 4: Spend 20% on Savings and Debt

Devote this the remaining 20% of your after-tax income to paying down existing debt and creating a comfortable financial cushion to avoid taking on any future debt. You can start your own emergency fund, save for retirement through a 401(k), or focus on repaying your high-interest debt.

To learn more information about how Pioneer can be a financial partner in helping you achieve your goals, call or visit one of our branch locations.

Disclaimer

The material provided on this website is intended for informational purposes only. Links to other web sites are provided for reference and do not constitute a referral or endorsement by Pioneer or its affiliates. Please note that such material is not updated regularly and that some of the information may not be current. It is recommended that you consult with a financial professional for assistance regarding the information contained herein.