Establishing a Budget as a New College Graduate

Congratulations, you just achieved one of your major milestones, graduating college! Attaining a goal of any kind is a huge accomplishment, but completing college is always high on the list. But what’s next? You’ll be starting your new job, maybe wanting to buying a car, new clothes, moving into an apartment, and starting to pay off those dreaded student loans. There are plenty of questions to answer, but what can you really afford? Putting together a budget will help you determine whether you will be eating steak or Ramen each night!

Starting right out of college you may not have many expenses, but you might not have a steady source of income either. This could make developing a budget a bit challenging. But don’t fret, it can still be done.

Make sure to include even the smallest purchases as these can add up quickly, like your daily coffee or bagel. Try and project for at least six months to a year to get a better understanding and accurate financial picture. If you want to move out of your parent’s house in a couple of months, add in an estimated monthly rental fee. Don’t forget to include utility charges.

Again, this may be more of an estimate, unless you currently have a job or have been offered a job where you know your salary. But none-the-less you should try and determine what your realistic income may be. Make sure you factor in items like taxes and benefits. Uncle Sam will want his slice of your pie and healthcare benefits usually are not cheap. Your net paycheck will look very different from the gross amount you earn.

In addition to moving into your own apartment, you want to start paying off your student loans. Based on your current income and spending you can determine how much per month to allocate towards your student loans. Most lenders have repayment options corresponding to your income or even a deferral period if that first job is still eluding you. You may be eager to get those payments down quickly, but make sure you are not setting an unrealistic payment that will deplete your discretionary income for the occasional fun evening out.

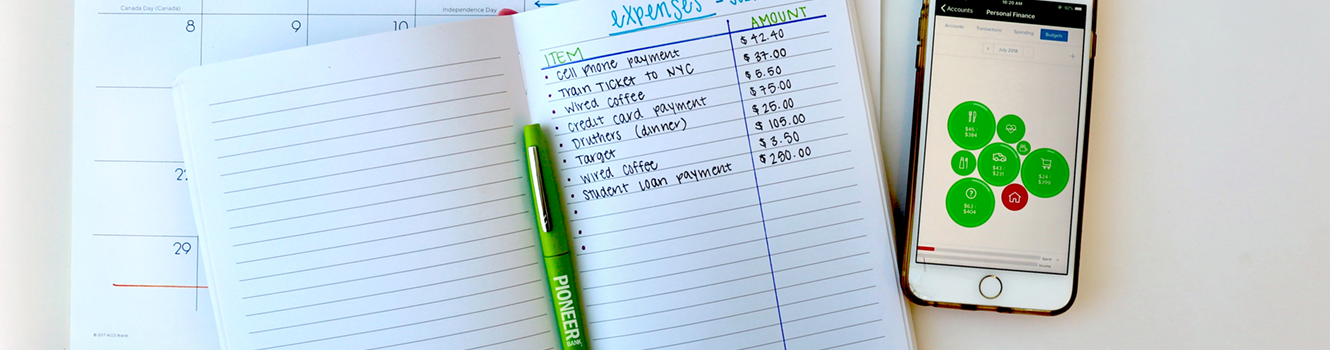

Creating a budget may seem daunting and maybe that’s why only 1/3 of Americans (32%) maintain a household budget, according to a Gallup poll. But when done properly and tracked it can be extremely beneficially to keeping you on the path towards your goals. That’s why Pioneer offers Personal Finance for all of your budgeting needs. This one-stop-shop application truly provides you with all the tools to keep your budget on track, whether you are at home or on the go.

To learn more about Pioneer’s Personal Finance Application and how Pioneer can become your financial partner, call us or visit one of our branch locations.

Disclaimer

The material provided on this website is intended for informational purposes only. Links to other web sites are provided for reference and do not constitute a referral or endorsement by Pioneer or its affiliates. Please note that such material is not updated regularly and that some of the information may not be current. It is recommended that you consult with a financial professional for assistance regarding the information contained herein.